Banqer Primary

features

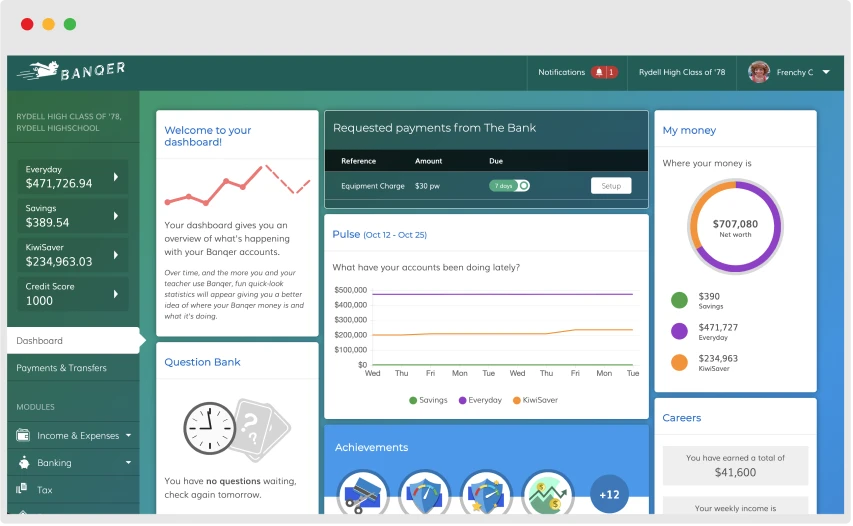

A financial education platform for the 21st century, Banqer covers a range of critical life skills.

Make learning fun with videos, quizzes and simulated events that build knowledge through experiential learning.

What your students

will learn

With our online simulation and supporting resources, your students will explore a range of essential financial concepts from income to banking, property to Superannuation.

Students are introduced to the concepts of earning income, and charitable giving.

Students are introduced to regular financial responsibility through weekly expenses, learning about money management and the difference between needs versus wants.

Students get a taste of what it’s like to be employed, learn about CVs, apply for classroom jobs and appreciate the responsibility of a paid job.

Students will explore what it means to have a bank account, including overdrafts, debt management, and the benefits and consequences of their management choices.

Students will explore how money in a savings account can earn interest, learning the power of regular contributions and compound interest.

Students will gain an increased comprehension of interest, while improving their money management skills, developing the ability to lock away funds for a period of time.

Students are introduced to the concept of retirement funds, contributions, and the process of planning and saving for retirement.

Students are introduced to tax, as well as tax brackets and rates, learning how tax is calculated, deducted and used in the real world.

Students are introduced to the property market, mortgages, deposits, rental income, and property expenses.

Students are introduced to different types of insurance, premiums and claims, learning how to identify risk and the benefits of being covered (or the consequences of not!)

Students investigate purchasing and selling private transport like scooters, bikes and cars, and how various transport options affect budget management.

Make learning fun

Capturing your students’ attention is easy with Banqer Primary. We simulate real life events, like earning salaries for doing class jobs and buying your first car, to keep students coming back.

Our student videos make financial concepts accessible to different learning styles.

Learning is enhanced with pre-prepared group activities where students can apply their knowledge in fun ways. Innovative ideas for bringing Banqer alive in the classroom are also shared on our Banqer Primary community.

Motivate and incentivise

your students

Banqer comes with an inbuilt incentive system for use in your learning environment.

Motivate your students to complete classwork or positively reinforce behaviour you want to see with Banqer dollars. Students can then exchange these for rewards in the classrooms, or use them to purchase transport or property straight from their dashboards. They can even donate to a charity of their choice within the platform.

Still have questions on how Banqer Primary works?

A few common questions that schools have when deciding how to get started with Banqer Primary. To see all of these head over to our FAQs page.